Most investors understand the importance of using losses to offset gains and reduce taxes, also known as tax-loss harvesting. But what happens when a minor, who has little or no income, experiences a loss in their Uniform Transfers to Minors Act (UTMA) custodial account?

Losses can occur when shares are sold to withdraw funds or to change investments. Unfortunately, the parents cannot report the child’s loss on their own tax return. The loss belongs to the child, and the child’s capital gains or losses must be reported on their own tax return. In some cases, parents may be able to claim the child’s income, but this is only true for certain sources of income.

So what happens if a child’s income isn’t enough to realize the full loss?

Carrying over losses

Capital losses aren’t a use-it-or-lose-it scenario. This is good news for all of us, but especially for minors with small incomes who may not yet be able to fully benefit from their losses. Capital losses can be carried over from year to year, as long as the correct forms are completed.

The IRS limits capital loss deductions to $3,000. You may be familiar with this from your own tax return. If you have capital loss deductions over the $3,000 limit, you can carry over whatever is left to the next year.

This is also true for children who cannot use their capital loss deductions. Whether it’s because their incomes are lower than the capital loss, or if they had a higher income but could only use the first $3,000 in losses, either way, the capital loss can be carried over to the next year.

Completing the minor’s tax return

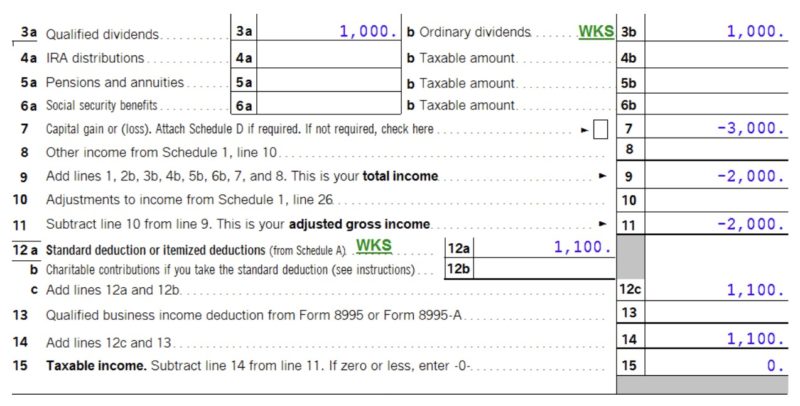

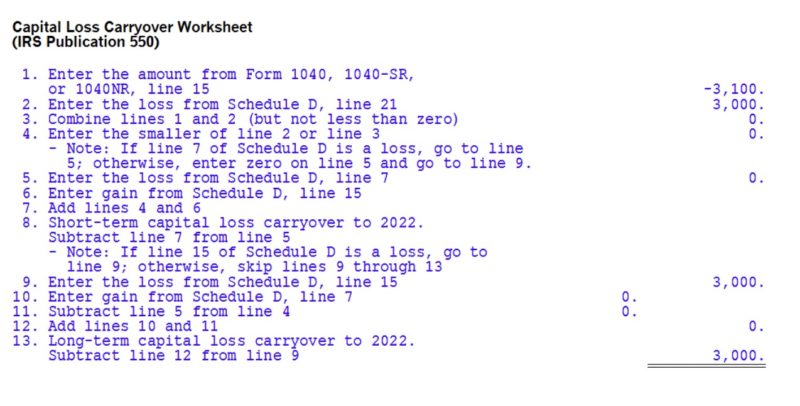

To better understand how this works, let’s make up an example. A child has $1,000 in dividend income, but also has a $3,000 capital loss. When completing the tax return, it may appear that the $1,000 of dividend income is offset by the $3,000 capital loss leaving only $2,000 of capital loss available for carryover, but that is not the case.

As shown in the capital loss carryover worksheet on the tax return, the child is allowed to carryover the entire $3,000 of capital loss because the child’s $1,100 standard deduction wipes out the entire $1,000 of dividend income. Since the child’s income was so low for the year, they didn’t receive any benefit from their capital loss in that year. As a result, they can carry over the entire capital loss to the next year.

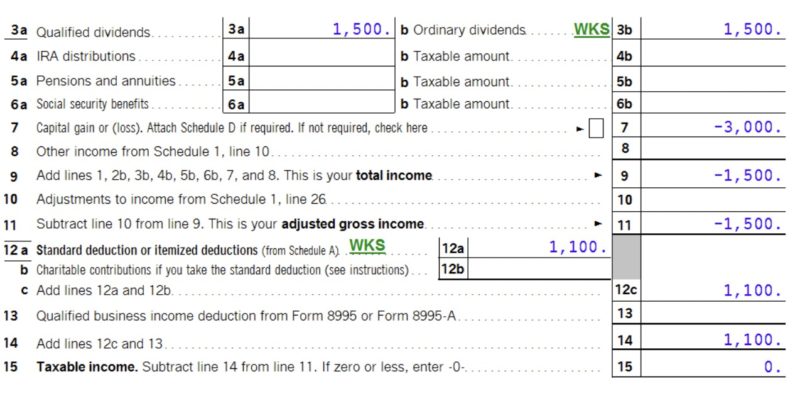

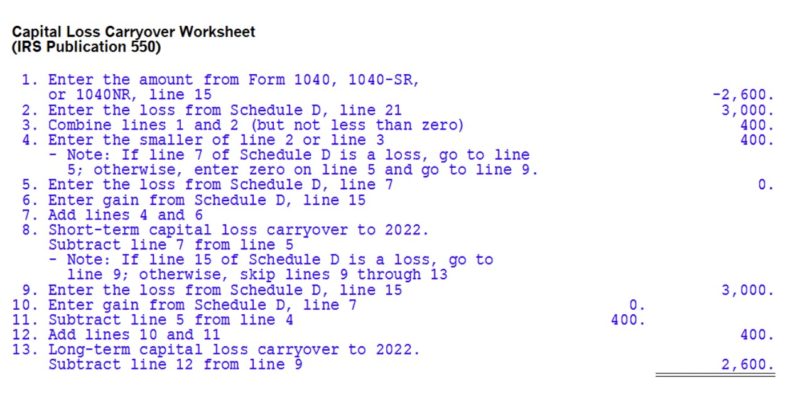

The results would be different if the child’s income was greater than their standard deduction. Assume the child had $1,500 of dividend income and $3,000 of capital losses. In this scenario, the $1,100 standard deduction would offset the dividend income with $400 remaining. The $400 would be offset with the $3,000 capital loss and $2,600 carryover to the following year.

Carrying over losses to future years

Capital losses can be carried forward indefinitely and will be listed on Schedule D of next year’s tax return. Then, it will be combined with any gains or losses from that year. If the net result is a loss, it can again be carried forward.

While there’s no deadline to use capital losses, you must list them on your tax return every year, even if it would be more beneficial to save them for a future year. You may not choose to save them.

Combining capital losses with capital gains

The scenario above is an example of what could happen if the child had no capital gains but had income from other sources (in this case, dividends). The child was able to carry forward the entire capital loss.

However, if the child had capital gains, those gains would have been combined with the losses, and the gains would have offset the loss. If the child had the $300 in interest, $500 in capital gains, and $2,500 in capital losses, the net loss would have been only -$2,000. Even though the $500 in capital gains combined with the $300 interest would still have been less than the standard deduction of $1,150, the capital gain must be combined with the capital loss. While your child still wouldn’t pay any taxes, only -$2,000 may be carried forward to the next year.

Looking for an independent fiduciary financial advisor who can advise you on investments, retirement, real estate, alternative assets, and taxes? Contact ACap Advisors & Accountants to schedule a free initial consultation. Our clients include individuals, small businesses, entrepreneurs, and anyone serious about saving and investing for their future.