What are Treasury Bills (T-Bills)

Treasury Bills (T-Bills) are short-term debt issued by the US government. T-Bills play a crucial role in the economy by helping the government raise funds to finance its operations and manage the national debt. All debt issued by the US government is deemed very safe with little to no risk of default. US Treasuries are considered the safest investments in the world which is why whenever there is turmoil in the world, investors flock to US Treasuries as a safe haven. T-Bills have maturities of less than 1-year (12 months) and are issued in six terms: 4 weeks, 8 weeks, 13 weeks, 17 weeks, 26 weeks, and 52 weeks.

T-Bills, Treasury notes, and Treasury bonds are all forms of debt issued by the U.S. government, the only difference among them are their maturities. Notes are short or medium term debt with maturities between 2 and 10 years whereas bonds are long term debt with maturities of 20 years or more. Also, notes and bonds pay interest every six months, but T-Bills pay interest upon maturity.

Taxation of T-Bills

Interest you earn on T-Bills (as well as all Treasury marketable securities) are exempt from state and local taxes, but are still subject to federal income taxes. This state tax exemption makes T-Bills very appealing to investors in high income tax states such as California and New York. Treasury marketable securities exempt from state and local taxation includes: Treasury Inflation Protection Securities (TIPS), notes, bonds, and Floating Rate Notes (FRN).

You will still receive a 1099-INT showing the interest earned on your T-bill. The interest shown in box 1 of the 1099-INT is reported on Schedule B on your 1040 similar to interest you earn on a bank savings account. Although uncommon, you can elect to withhold up to 50% of your interest earned towards federal taxes. If you decide to have federal taxes withheld, your 1099-INT will show the total amount of interest you earned on box 1 and the amount of federal tax withheld in box 4.

T-Bills are sold at a discount and pay interest at maturity. For example, a $1,000 T-Bill may be sold for $980. At maturity, you will receive $1,000 even though you paid $980: the $20 difference would be interest earned. Interest earned on T-Bills is taxed at ordinary income tax rates.

Why buy T-Bills?

The T-Bill market is over $27 trillion which makes them the most liquid investment in the world. Liquidity is defined as how quickly you can convert an investment into cash. Because of the massive size of the T-Bill market, investors can easily park hundreds of millions of dollars into T-Bills as a safe cash equivalent. Until the recent rapid rise in interest rates, T-Bills were not very attractive investments because their yields were very low. The rise of short-term interest rates by the Fed also increased the rates on T-Bills, making them very appealing to savers. If the Fed lowers interest rates, then T-Bill rates will also decline, but then so will rates on bank savings accounts.

T-Bill Tax Equivalent Yield

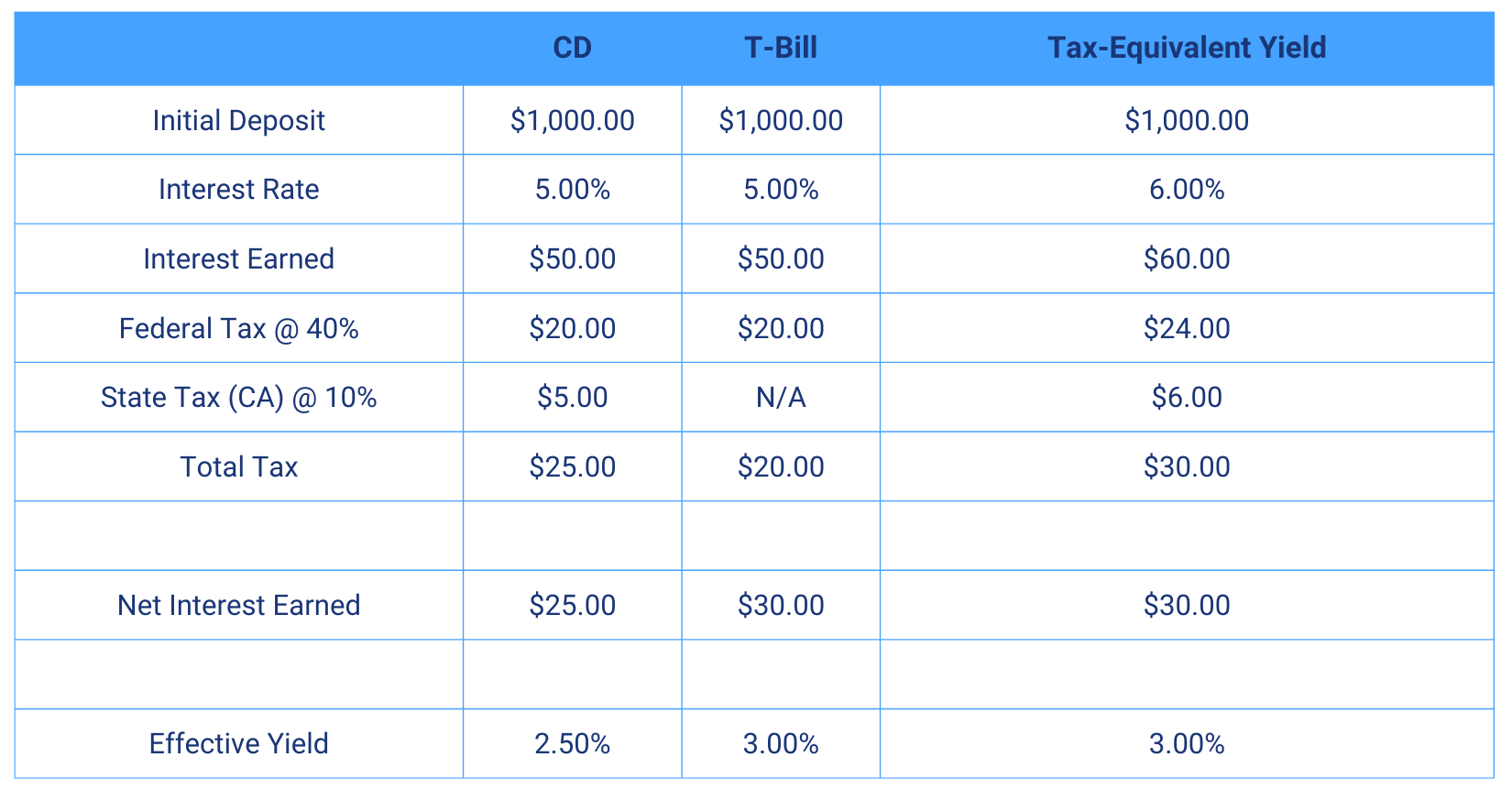

Because T-Bills are exempt from state and local taxes, an investor living in a high tax state such as California or New York should carefully calculate the tax equivalent yield of an alternative investment such as a bank savings account or Certificate of Deposit (CD). For example, assume you live in California and are in the 40% federal and 10% California tax brackets and you plan to invest $1,000 in either a bank CD or a T-Bill. Below is a calculation how the two investments compare if the interest rates were the same at 5% and how much more you would need to earn in a CD to equate to a similar T-Bill investment.

How to purchase T-Bills

You can either purchase T-Bills directly from the US Treasury through www.TreasuryDirect.gov or through your brokers such as Charles Schwab, Fidelity, E-Trade, and other similar brokers. T-Bills are only sold in electronic form.

Commonly Asked Questions on T-Bills

Do I have to hold a T-Bill until it matures?

No, you can sell a T-Bill anytime you want and do not have to hold it until maturity. Your interest income will be from the time you purchased the T-Bill until the time you sell it.

What happens when the T-Bill matures?

When a T-Bill matures, you simply get the face value of the T-Bill in cash. You then have to decide if you want to reinvest the money back into a T-Bill or any other investment.

Does a T-Bill automatically reinvest upon maturity?

No, you get the face value of the T-Bill back and you decide if you want to reinvest the proceeds.

Are T-Bills FDIC Insured?

T-Bills are not FDIC insured, but they are backed by the full faith and credit of the US Government.

Why should I buy T-Bills?

T-Bills are currently a good alternative to bank savings accounts and a safe place to park short-term funds such as your emergency fund or money earmarked for a large purchase in the near term. T-Bills are not a good long-term investment because their interest rates are less than inflation.

Are Treasury bills (T-Bills) better than Certificates of Deposits (CDs?)

It depends on the interest rate offered by each instrument. When interest rates are equal, T-Bills are better than CDs because T-Bills are exempt from state and local taxes. The interest rate offered by a CD should be higher than a T-Bill to offset that state and local tax exemption benefit.

Do you pay state tax on Treasury Bills (T-Bills)?

No, T-Bills are exempt from state and local taxes.

Do you pay federal tax on Treasury Bills (T-Bills)?

Yes, T-Bills are not exempt from federal income taxes.

Do you pay capital gains tax on Treasury Bills (T-Bills)?

Yes, but unlikely. You will owe capital gains only if you sell your T-Bills for more than you paid for them, which is uncommon.

Looking for an independent fiduciary financial advisor who can advise you on investments, retirement, real estate, alternative assets, and taxes? Contact ACap Advisors & Accountants to schedule a free initial consultation. Our clients include individuals, small businesses, entrepreneurs, and anyone serious about saving and investing for their future.