No one likes losing money on a stock, but sometimes it happens. You pick a hot stock you think has great potential but then it crashes and becomes worthless. You hold on hoping for it to recover, but it simply stops trading and you cannot sell it. So how do you deduct a worthless stock on your tax return if you haven’t actually sold the stock because it is no longer traded and you have not received a 1099 from your broker to prove to the IRS that your stock is worthless?

What is a worthless stock?

A worthless stock is a security that is either no longer traded or has a zero market value. According to the IRS, a worthless stock can also include a stock that you have abandoned, meaning you have given up all of your ownership rights to the security. An example of a worthless stock is a company that has gone bankrupt or is undergoing liquidation because it is unlikely you will get your money back. A worthless stock is not one that has lost substantial value but is still traded and can be sold. If the stock is still traded, you can simply sell the stock and incur a realized loss.

A stock that has lost substantial value and is trading below $4 per share is called a penny stock as defined by 17 CFR 240. Penny stocks are considered very risky and can potentially become worthless, especially if the company was once a large company; a good example is First Republic Bank, which was once a large well known company before it became a penny stock and eventually closed down.

Examples of worthless stocks

History has many examples of venerable companies going bust, such as General Motors (2009), Lehman Brothers (2008), Enron (2001), Worldcom (2002) and the list goes on. Below are some recent examples of worthless stocks.

- Bed Bath & Beyond

- First Republic Bank

- Silicon Valley Bank

- Signature Bank

- WeWork

- FTX

How to report worthless stock on your tax return

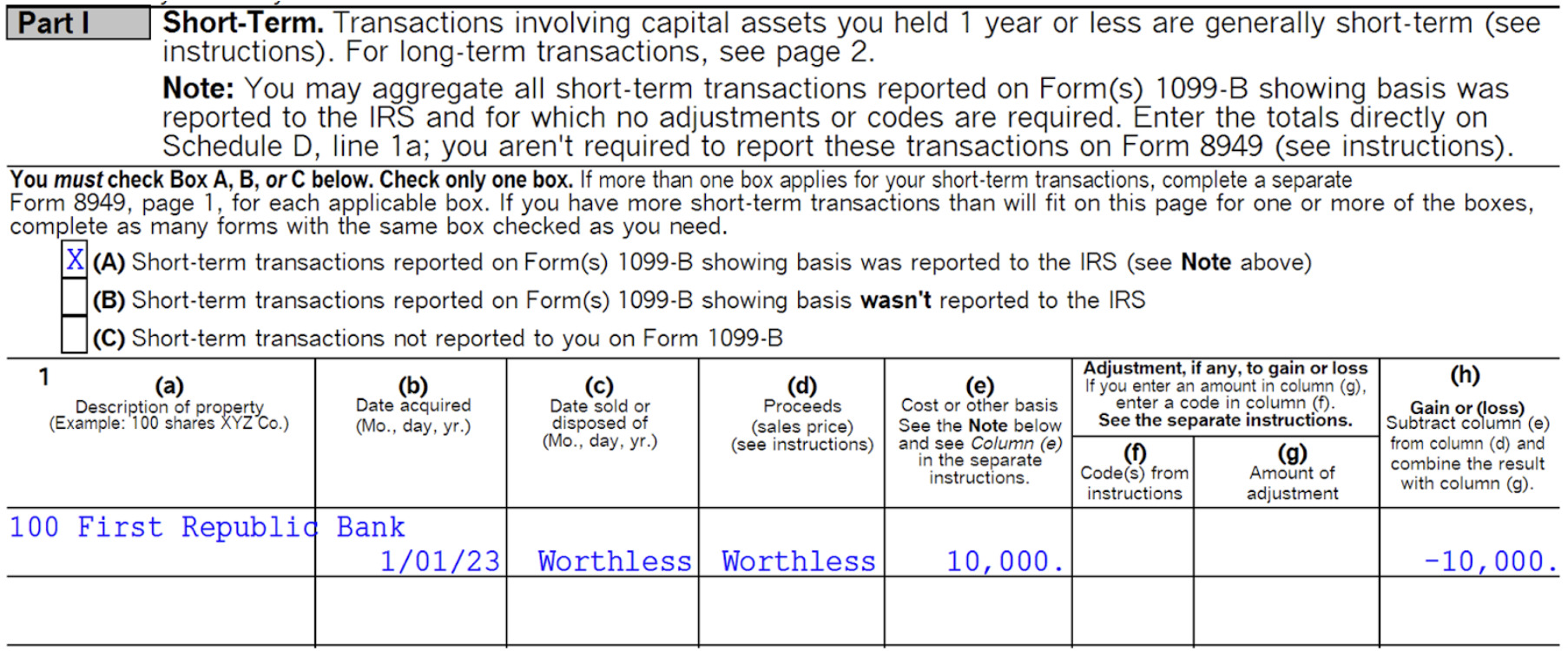

Worthless stocks/securities are reported on IRS Form 8949 of your tax return which is then summarized on Scheduled D. You must first report the stock on Form 8949 because you did not actually sell the stock and did not receive a 1099 from your broker. Follow the steps below to report the loss of a worthless stock:

Use Part 1 for short-term (if you held the security for 1 year or less) and Part 2 for long-term (if you held the security for more than 1 year).

Description of property: write the name, number of shares, and symbol (if available) of the security.

Date acquired: write the date you purchased the security. If you purchased the security on multiple occasions, then write “various” or you can write out each date of purchase separately.

Date sold: write “worthless”

Proceeds: write “worthless,” unless you received any funds from the worthless company (highly unlikely).

Cost: write how much you paid for the security. If you purchased the security on multiple occasions, then write the total cost or write out each date of purchase separately.

Adjustments (f) and (g): For most transactions you do not need to complete columns (f) and (g). The most common reason you may need to complete these columns is if you received a 1099 that had incorrect information on it.

Short-Term vs. Long-Term Loss

The capital loss from a worthless security can be either short-term or long-term. The loss is considered short-term if the security was held for 1 year or less and long-term if the security was held for longer than 1 year.

When do you deduct a worthless stock?

A worthless stock deduction is taken in the year the security is deemed worthless. To claim a deduction, you must establish that the stock became worthless during the tax year you are filing for. For example, investors in First Republic Bank stock would have taken a worthless stock deduction in 2023 when the stock stopped trading.

How do you prove a stock is worthless?

To prove a stock is worthless and take the worthless stock deduction, you must show that the stock is no longer traded, has declared bankruptcy, has no market value (if not publicly traded), or is in the process of liquidation. This can include public records, news articles, or correspondence from the company itself. If the stock is still showing on your brokerage account, but has a zero balance, you can use the zero balance as justification of a worthless stock. Alternatively, you can take a screenshot of you unsuccessful trying to sell the stock to prove that the stock is no longer traded.

How do you liquidate worthless stocks?

In many cases you cannot liquidate a worthless stock because it is no longer traded. You can abandon the shares by calling your broker and having them remove the shares from your account. Abandoning your stock means you are giving up all of your rights to the stock.

What is the maximum loss I can take on a worthless stock?

The maximum loss you can incur on a worthless stock is equal to the total amount of money you invested in the security subject to capital loss limitations. The maximum deduction on a worthless stock deduction is the same as any other capital loss. You can deduct up to $3,000 of realized losses per year assuming you have no realized gains from the sale of other securities. Any unused losses are carried forward to use in future years. If you have realized capital gains, you can apply any unused realized losses against your gains. For example, if you have $10,000 of realized gains and $15,000 of realized losses, you can offset your entire capital gains with your losses, plus utilize $3,000 of losses in the current year, and still carry over $12,000 to use in future years.

Looking for an independent fiduciary financial advisor who can advise you on investments, retirement, real estate, alternative assets, and taxes? Contact ACap Advisors & Accountants to schedule a free initial consultation. Our clients include individuals, small businesses, entrepreneurs, and anyone serious about saving and investing for their future.